Economist Nguyen Quang Huy, CEO of the Finance and Banking Department at Nguyen Trai University, described this as a turning point, introducing competition in a market long dominated by the SJC brand.

“With this new regulation, once qualified banks and enterprises can participate, the supply of gold bars will gradually improve. This lays the groundwork for a more transparent market that better reflects international prices,” Mr. Huy said.

However, he stressed that this is a long-term effect. In the short term, the market is unlikely to change immediately due to licensing delays, production setup, and the time needed to build consumer trust.

He noted that in the short term, gold prices in Vietnam are unlikely to fall significantly because trust in the SJC gold brand remains high. New brands will need time to prove their quality and liquidity.

“Due to global economic uncertainties and limited physical gold supply domestically, the high prices will persist. Over the medium to long term, as banks and businesses increase supply, the gap between domestic and international prices will narrow. But this transition could take 12 to 24 months - or longer - for the system to run smoothly,” Mr. Huy added.

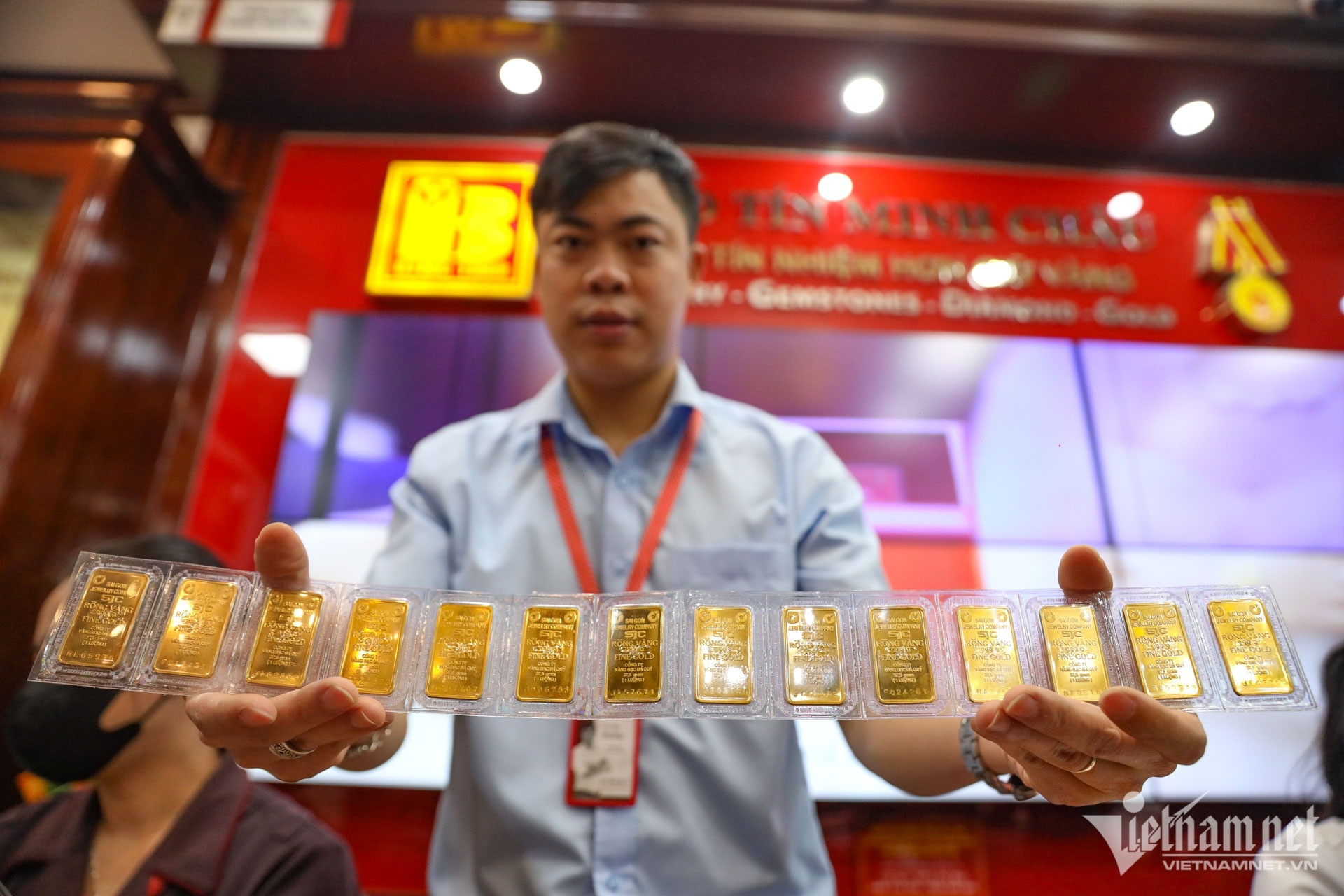

With over a month left before the decree takes effect, domestic SJC gold prices remain elevated, currently at 127-128.5 million VND per tael (equivalent to approximately USD 5,000 - 5,060 per tael as of August 28). So, should current gold holders sell now?

In response, Mr. Huy said the decision depends on each investor’s risk appetite and expectations.

“For short-term investors, record-high prices are an opportunity to lock in profits and reduce exposure to a potential downturn. For those holding gold as a long-term hedge against global instability and inflation, they may continue holding but must be ready for high volatility,” he advised.

He also recommended that investors diversify their portfolios instead of placing all capital in gold. Combining assets helps balance risks more effectively.

Call for dedicated agency to regulate gold market

Dr. Nguyen Tri Hieu, another prominent economist, agreed that abolishing the State monopoly on gold bar production and the import/export of gold materials under Decree 232/2025 will make the market more open, ensure fairness among market participants, and support product diversification.

He stressed that reforms must go beyond legislation and into implementation. “Unless there are clear actions - like removing SJC’s status as the national gold brand or allowing commercial banks and companies to import gold - the market won’t change much,” he said.

Dr. Hieu estimated that domestic prices might drop by 5-10 million VND per tael (approximately USD 200-400), but only if global prices remain stable. If global prices rise, domestic prices will likely follow.

As new gold products enter the market, Dr. Hieu argued that the current regulatory framework, overseen by the State Bank of Vietnam (SBV), may be inadequate. He emphasized that gold is a valuable commodity rather than a monetary unit and thus falls outside SBV's monetary policy scope.

He proposed establishing a specialized agency dedicated to managing the gold market, independent of the SBV. This body would oversee price stability, regulate supply and demand, close the domestic-international price gap, control illegal trade, and supervise gold business activities.

According to Dr. Hieu, the Ministry of Finance would be the appropriate authority to manage this function.

Nguyen Le